The saga of Mt. Gox continues to unfold, with recent movements of 4,000~ Bitcoin (BTC) by the Trustee raising eyebrows and sparking discussions among the cryptocurrency community. According to Arkham, since November 5th, the Trustee has moved approximately 4,000 BTC out of their wallets. This movement has left many wondering about the implications for creditors and the future of the remaining assets.

The Current State of Mt. Gox Holdings

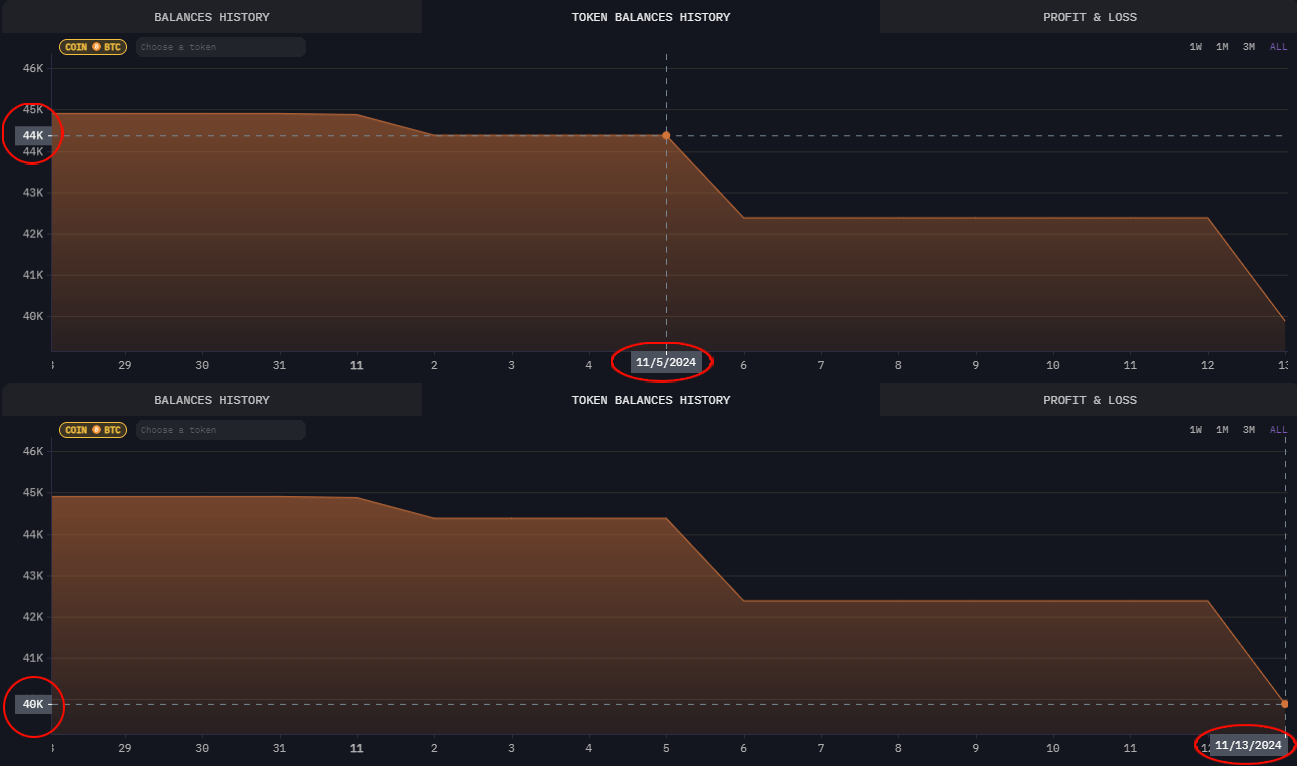

As of November 5th, the Trustee held around 44,000 BTC. However, as of now, that number has decreased to approximately 39,878 BTC. This significant reduction in holdings has led to speculation about the fate of the 4,000 BTC that have been moved. One of the wallets that the Trustee controls holds a substantial amount of BTC, specifically 27,871 BTC at 1FhodFYr1SDZD4XawyMJfmmfLenAAQLFRT. The whereabouts of the remaining 12,000 BTC remain unclear, leading to further inquiries into the Trustee’s actions.

The Mysterious Transfers

The question on everyone’s mind is: where did the 4,000 BTC go? Preliminary investigations suggest that a significant portion may have been sent to B2C2, a liquidity provider. The B2C2 wallet labled bc1qq3azgxcv9ktc0hq6jh8tr64ausf75jxf8t6pdl has seen multiple transfers from the Trustee’s wallets in the past week, indicating a possible liquidation of assets. This raises concerns about whether the Trustee is selling off coins to meet obligations or if there is a more strategic plan in place.

Additionally, another wallet connected to Mt. Gox has been identified, which can be explored at 15RRUfjpnLjLMicix7kBorpwGsgKULhiAu. By examining the last two transactions from this wallet, it becomes evident that one transfer goes to B2C2 while the other returns to the Trustee’s wallet. This pattern of transactions suggests a complex web of asset management that is difficult to track.

Speculation and Theories

The community is rife with speculation regarding the Trustee’s intentions. Some /r/mtgoxinsolvency Reddit users have expressed concerns that the Trustee may be selling off coins to fulfill cash payments to creditors, while others believe that the remaining coins are being held back due to ongoing legal disputes, particularly with Coinlab. One user noted, “I’ve just assumed they will keep a ton of coins due to Coinlab legal disputes… What happens to those coins when Coinlab loses is something I’ve never heard anyone explain.”

This sentiment reflects a broader uncertainty about the future of the remaining BTC. The Trustee has a responsibility to treat all verified creditors equally, which complicates the distribution process. As one user pointed out, “They have to sell and distribute to all verified creditors at roughly the same time.” This means that any sales or distributions must be carefully managed to avoid preferential treatment.

The Implications for Creditors

The ongoing movements of BTC by the Trustee have significant implications for creditors. Many are left wondering how the Trustee’s actions will affect their claims and whether they will see any returns on their investments. The uncertainty surrounding the distribution of assets has led to frustration among creditors, with some expressing doubts about the Trustee’s management of the situation.

One user remarked, “Selling the remaining coins right now at this pace would indeed take about a year… Therefore they’re probably just going to end up to the Japanese government.” This highlights the concern that creditors may not see their claims fulfilled in a timely manner, if at all.

Conclusion

The recent movements of BTC by the Mt. Gox Trustee have opened up a Pandora’s box of questions and concerns among the cryptocurrency community. As the Trustee continues to navigate the complexities of asset management and creditor distribution, the fate of the remaining BTC remains uncertain. The discussions on platforms like Reddit reflect a community eager for clarity and resolution.

As we await further information from the Trustee, it is crucial for creditors to stay informed and engaged. The situation is fluid, and the implications of these movements could have lasting effects on the future of Mt. Gox and its creditors. For now, all we can do is speculate and hope for a resolution that serves the best interests of all parties involved.