Category Crypto Page 1 of 7

-

Understanding Seed Phrases in Bitcoin Wallets

Understanding Seed Phrases in Cryptocurrency Wallets

-

Atomic Swaps 101: Swap Bitcoin Like a Pro + How It All Works

Hey Bitcoin fam! Want to trade your BTC for another crypto without centralized exchanges sucking up fees? Enter atomic swaps—the trustless, peer-to-peer magic that’s changing the game. In this guide, we’ll show you how to do an atomic swap step-by-step, then dive deep into the tech that makes it tick. Let’s roll!

-

The Bitcoin Genesis Block: The Birth of Cryptocurrency

The Bitcoin Genesis Block: The Birth of Cryptocurrency

-

Mt. Gox Repayments Begin Once Again. A Community Celebrates and Reflects on a Long Journey

After years of uncertainty and anticipation, the Mt. Gox community is finally witnessing the beginning of repayments to creditors. Despite headlines suggesting that most creditors have been paid and the case is resolved, nearly half of the creditors are still awaiting their payments due to various factors.

-

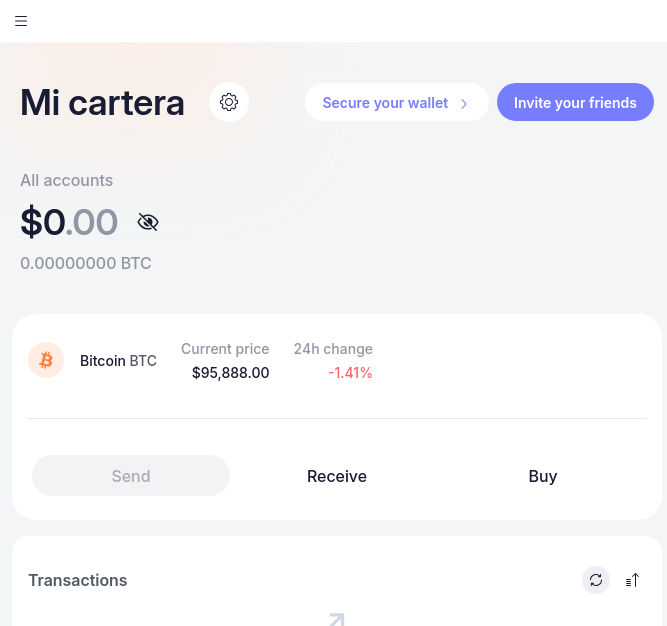

Review of Proton Wallet by ProtonMail

In the ever-evolving landscape of digital finance, Proton Wallet emerges as a noteworthy contender, offering users a safer and simpler way to manage their Bitcoin. With its recent launch, Proton Wallet aims to empower individuals to take control of their financial destinies without the constraints of traditional banking systems or centralized exchanges.

-

Claim & Exchange Bitcoin Forks. How to Extract Altcoins from Your Old Bitcoin Wallets

Do you have a backup of Bitcoin Wallet from years ago that used to have an impressive balance? During the height of Bitcoin forks, numerous new coins emerged, often capturing the attention of investors and enthusiasts alike. Your private keys, once the gateway to an impressive balance, may still hold the potential for significant value in these forked coins, which could be worth thousands today.

-

Saquon Barkley, Jack Dorsey, and Jack Mallers Sport Satoshi Nakamoto Shirts at Recent Gathering

In a recent sighting that has sparked interest in both the sports and cryptocurrency communities, NFL star Saquon Barkley was spotted alongside Twitter co-founder Jack Dorsey and Strike CEO Jack Mallers, all wearing shirts emblazoned with “Satoshi Nakamoto,” the pseudonymous creator of Bitcoin.

-

The Global Pursuit of a Bitcoin (BTC) Strategic Reserve

The International Race for a Bitcoin (BTC) Strategic Reserve

-

Trump Media Launching Bitcoin ETFs Under Truth.Fi

In a surprising turn of events, Trump Media and Technology Group (TMTG), previously led by U.S. President Donald Trump, is set to enter the financial markets with the launch of three exchange-traded funds (ETFs), including a fund focused on Bitcoin (BTC). This announcement, made on February 6, 2025, marks a significant step for TMTG as it seeks to establish a foothold in the rapidly evolving world of cryptocurrency investments.

-

The Bitcoin Rich List. A Look at the Wealthiest Addresses

Bitcoin, the pioneering cryptocurrency, has created a new class of wealth and financial power. As of October 2023, the Bitcoin rich list reveals a fascinating array of addresses holding significant amounts of Bitcoin. This article delves into the top addresses, their backstories, and the implications of their holdings in the broader cryptocurrency ecosystem.